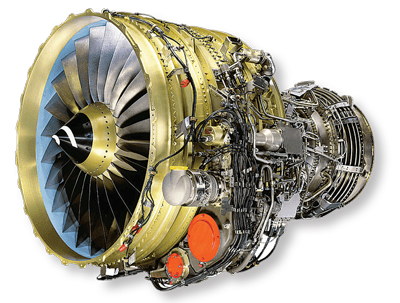

Large Jet Engines: Power With Fuel Eficiency

NASA indicates that with advanced aerodynamics, structures and geared turbofans, fuel savings of up to 50 per cent by 2025, is possible and up to 60 per cent by 2030

The turbofan engine market is dominated by a handful of mostly Western players. These are General Electric, Rolls-Royce, Pratt and Whitney, in order of market share. General Electric and Safran of France have a joint venture, CFM International. Pratt & Whitney also has a joint venture known as International Aero Engines with Japanese Aeroengine Corporation and MTU Aero Engines of Germany. Pratt & Whitney and General Electric have a joint venture, Engine Alliance. There are others such as Honeywell Aerospace and some Russian, Ukrainian and Chinese engine companies.

Engine fuel efficiency has a direct impact on total fuel consumption and in turn, on the cost of airline operations. As per the International Air Transport Association (IATA) fuel fact sheet, the global airline industry’s fuel bill estimated to have totalled $188 billion in 2019, accounted for around 23.7 per cent of operating expenses. Major engine manufacturers are adopting measures to improve fuel efficiency.

GE AVIATION ENGINES

With more than 33,000 engines in service, General Electric Aviation has the largest share of the turbofan engine market. The CF6 engine family is the cornerstone of the wide-bodied engine aircraft business for 45 years. GE90 engine family with composite fan blades, powers all Boeing 777 models. GE90-115B has a thrust of 115,300 lbs. GE9X is the most fuel-efficient jet engine GE has ever produced on a perpounds-of-thrust basis. It is designed to deliver a ten per cent improved fuel burn compared to the GE90-115B. The GEnx is the fastest-selling, highthrust jet engine with over 2,700-plus engines in-service and on order. Based on proven GE90 architecture, the GEnx engine offers up to 15 per cent improved fuel efficiency and 15 per cent less CO2 emission compared to GE’s CF6 engine. It powers the Boeing 787 Dreamliner as also the four-engine Boeing 747-8. The GP7200 engine comes in collaboration with Pratt & Whitney and powers the A380.

ROLLS-ROYCE

Rolls-Royce is famous for Trent series of high-bypass turbofan engines that have been in service for 25 years on the Airbus A330, A340, A350, and A380, as well as the Boeing 777 and the 787 Dreamliner. Its first variant, the Trent 700, was introduced on the Airbus A330 in 1995; Trent 800 for the Boeing 777 in 1996; the Trent 500 for the A340 in 2002; the Trent 900 for the A380 in 2007; the Trent 1000 for the Boeing 787 in 2011; the Trent XWB for the A350 in 2015 and the Trent 7000 for the A330neo in 2018. The Trent 7000, compared to the Trent 700 that powers the A330, doubles the bypass ratio to 10:1 and halves the emitted noise level. Fuel consumption is improved by 11 per cent.

Engine fuel efficiency has a direct impact on total fuel consumption and in turn, on the cost of airline operations

PRATT & WHITNEY

With over 13,000 large commercial engines installed today, Pratt & Whitney is third behind GE and Rolls-Royce in market share. It is now a subsidiary of Raytheon Technologies. The JT9D engine powered the original Boeing 747 Jumbo jet. The PW4000 series is the successor to the JT9D and powers some Airbus A310, Airbus A300, Boeing 747, Boeing 767, Boeing 777, Airbus A330 and MD-11 aircraft. The PW4000 has three variants with different fan diameters varying from 94-inch to 112-inch powering different aircraft including the Boeing 777. The GTF engine, with its revolutionary Geared Fan Technology (GTF), is delivering game-changing economic and environmental performance and powers Airbus A220, the Airbus A320neo family and Embraer E190-E2. It is being tested on the Mitsubishi Regional Jet (MRJ) and Irkut MC-21. The GTF-powered A320neo has achieved a 16 per cent reduction in fuel consumption, a 75 per cent reduction in noise footprint and a 50 per cent reduction in nitrogen oxide emissions. V2500 engines offer the most advanced technologies in the 22,000 to 33,000 pound thrust range. The 70,000-pound thrust GP7200 engine is derived from two of the most successful wide-bodied engine programmes, the PW4000 and GE90 families. The twin-spool axial flow turbofan powers the Airbus A380.

CFM INTERNATIONAL

CFM International is a joint venture between GE Aircraft Engines and SNECMA of France. They have created the very successful CFM56 series, used on Boeing 737, Airbus A340, Airbus and A320 family of aircraft. CFM56 has a 60 per cent share of the A320neo market. CFM also makes the famous Leading Edge Aviation Propulsion (LEAP) engines. LEAP’s basic architecture includes a scaled-down version of Safran’s low pressure turbine used on the GEnx engine and makes greater use of composites. The engine has some of the first FAA-approved 3D-printed components. LEAP powers the A320neo, Boeing 737 MAX and COMAC C919.

POLICY AND OPERATING ISSUES

The FAA Modernisation and Reform Act of 2012 brought in the need for aviation fuel Research and Development and review of energy and environment related issues. Fuel-efficient engines remain the most important factor, but other factors such as airframe design, cruise speed choice also make a favourable impact on the fuel efficiency of airlines.

ENGINE TECHNOLOGY

The Adaptive Cycle Engine (ACE), unlike traditional engines with fixed airflow, is a variable cycle engine that will automatically alternate between a high-thrust mode for maximum power and a high-efficiency mode for optimum fuel savings. ACE is designed to increase aircraft thrust by up to 20 per cent, improve fuel consumption by 25 per cent and to extend range by over 30 per cent. The ADaptive Versatile ENgine Technology (ADVENT) programme is an aircraft engine development programme with the goal of developing an efficient adaptive cycle or variable cycle, engine for next-generation aircraft. Rolls-Royce, GE Aviation and Pratt and Whitney are major participants in the programme. Growth of computer technology and the microelectronics revolution allows full-authority electronic digital control of aircraft engines. The smart engine has huge magnitude of computational power that supports improved engine efficiency and reduces fuel consumption.

The smart engine has huge magnitude of computational power that supports improved engine efficiency and reduces fuel consumption

ELECTRIC PROPULSION

There are challenges and opportunities for more-electric aircraft of the Boeing 787 or Airbus A350 class. Hydraulic and pneumatic systems such as those for actuation or air conditioning are already being replaced by electrical systems to save weight and improve reliability. Each 787 can produce around 1,000kVA for onboard systems, markedly more than previous-generation models. Onboard power storage has also grown significantly. Boeing will initially develop an electrically powered ten-seater aircraft and an electrically powered 180-seat short-haul aircraft is expected by 2027.

ICAO AND IATA PROPULSION TECHNOLOGY ROADMAP

The International Civil Aviation Organisation (ICAO) states that with technological advancements, airliners consume 80 per cent less fuel today than they did in 1960. This ratio has been dropping by one to two per cent annually. At the 2010 ICAO meeting, two goals for aviation were identified: two per cent fuel savings per year up to 2020 and neutralisation of carbon value as specified in Paris. A three per cent fuel saving target for each year was set for IATA member airlines. The IATA technology roadmap envisions reductions in engine fuel consumption, compared to baseline aircraft in service in 2015. This is in addition to savings due aircraft configuration and aerodynamics. It expected reduction by ten to 15 per cent from higher pressure and bypass ratios, lighter materials, implemented by 2020, 20 to 25 per cent from high pressure core and ultra-high bypass ratio geared turbofan, between 2020 and 2025, 30 per cent from “open rotors” from 2030 onwards, 40 to 80 per cent from Hybrid electric propulsion depending on battery use, from 2030 to 2040, and up to 100 per cent due to fully electric propulsion (primary energy from renewable source) from 2035 to 2040.

THE WAY AHEAD

NASA indicates that with advanced aerodynamics, structures and geared turbofans, fuel savings of up to 50 per cent by 2025, is possible and up to 60 per cent by 2030, with new ultra-efficient configurations and propulsion. By 2030, hybrid-electric architectures may be ready for 100-seater airliners. Engines embedded in the tail to ingest the low-energy fuselage boundary layer flow and re-energise the wake to reduce drag, are being considered by several designers. Boeing’s ecoDemonstrator programme is meant to enhance safety and reduce fuel consumption, emissions and noise. The Airbus/Rolls-Royce E-Thrust is a hybrid electric with a gas turbine engine and electric ducted fans with high energy storage batteries. Empirical Systems Aerospace (ESAero) is developing the 150-seat ECO-150 concept for turbo-electric distributed propulsion with two turbo-shaft engines mounted on the wing and driving generators powering ducted fans and improving propulsive efficiency to achieve 20 to 30 per cent fuel savings.