Helicopters in Asia-Pacific

For the rotary-wing fleet in the Asia-Pacific region, the future appears to be promising as despite the uncertainties and impediments, demand for helicopters in the region appears set to grow

The earliest reference to a device capable of vertical flight can be traced as far back in time as 400 BC when children in China played with wooden toys that had a spinning rotor that generated lift and enabled the toy to rise vertically and remained airborne till the energy imparted to the rotor mechanically ran out. However, it was only after the historic flight in 1903 in the United States by the Wright Brothers that the designers and engineers involved in the field of aeronautics which was still in a rather primitive stage, turned their attention to the development of rotary-wing flying machines. It was during the period of five decades after this historic achievement by the Wright Brothers in the regime of fixedwing heavier-than-air flying machine that there were significant development in the regime of rotary-wing platforms. The first real operational helicopter designed and built in Germany was by Doktor Heinrich Karl Johann Focke and was called the Focke-Wulf Fw 61 that undertook its maiden flight on June 26, 1936. The flight lasted for a mere 28 seconds. Several designs of rotary-wing platforms were developed thereafter, but were produced only in limited numbers. It was only in 1942 that a helicopter called the R-4 that was designed by Igor Sikorsky in the US and reached fullscale production with 131 aircraft built.

Initially, helicopters that went into production were built for use by the military as that was where the requirement was of a scale that justified heavy investments in setting up elaborate production facilities. However, the helicopters built for the military were also acquired by agencies, governments or even individuals, for civilian or commercial employment. Of course, these machines were expensive and had complex technologies because of which these were more difficult to maintain and operate.

Over the last eight decades, helicopters have been employed in very large numbers in civil and commercial applications all over the world. The number of platforms in civilian use however are still much smaller than that in the military regime. Leading the fleet of non-military helicopters deployed for commercial use was the Sikorsky S-51. However, the rotary-wing platform that was most widely used in civilian applications was the Bell 47 light utility helicopter which was employed for the transportation of personnel, survey and commercial observation. Other tasks for which helicopters were and continue to be employed include traffic monitoring and control, law enforcement, media coverage, aerial filming, survey, monitoring of oil and power lines, fighting fires over forests and built-up areas, logistic support to oil rigs, emergency medical evacuation and services, rescue of personnel from high-rise buildings in the event of fire, crop spraying, ranch and cattle management.

The Asia-Pacific Helicopter Fleet Today

In its little over 80 years of existence, the helicopter fleet has come a long way indeed. Although, the initial development of helicopters and expansion of fleets were largely confined to Europe and the US, the Asia-Pacific region has not been left behind in the race. The helicopter fleet in the Asia-Pacific region has sustained a steady rate of growth. In terms of technology, the originally developed platforms powered by piston engines have largely been or are being replaced by the newer platforms that are fitted with turbine engines. This trend will continue till the piston engine powered helicopters will be phased out completely in not too distant future.

As per the Fleet Report by Asian Sky, as of the end of the year 2016, the civil helicopter fleet in the countries in the Asia-Pacific region, the number of platforms powered by turbine engines stood at 3,924. This figure signified an increase of 4 per cent over the figure released at the end of 2015. However, the rate of growth in the year 2016 has been a little slower than that in the previous years. The downturn in oil prices continued to impact the Asia-Pacific region in 2016. In previous years, offshore oil and gas service providers were one of the main growth drivers for the region. In 2016, there was an overall reduction in the size of the Asia-Pacific fleet by 4.2 per cent. Reduction in the level of demand for offshore services impacted the growth of the fleets of Australia, China, Malaysia, Thailand and Indonesia.

In the Asia-Pacific region, 61 per cent of the helicopter fleet is owned and operated by four nations namely Australia, Japan, China and New Zealand. Overall, Australia represents the largest market for helicopters and today is the largest market for Bell Helicopter. Australia is followed by Japan which is the largest operator of helicopters from Airbus and Leonardo also known as AgustaWestland. China represents the largest market for Sikorsky helicopters. As has been the record in the last few years, China has been leading the growth in this field. In the year 2016, China has inducted 85 more helicopters into its civil fleet recording a year on year rate of growth of 21 per cent. New Zealand follows these three, with the largest market for platforms made by MD Helicopters Holdings Inc.

The Fleet Report by Asian Sky indicates that currently the mission profiles in the fleet of helicopters operated by the different nations in the Asia-Pacific region have, over the years, become increasingly diverse. A major part of the fleet, estimated to be in the region of 54 per cent, now have multi-mission capability. Helicopters employed for corporate tasks or for private use account for 12 per cent. Nine per cent of the fleet is dedicated to offshore commitments, 7 per cent for search and rescue tasks and 5 per cent for emergency medical services.

REDUCTION IN THE LEVEL OF DEMAND FOR OFFSHORE SERVICES IMPACTED THE GROWTH OF THE FLEETS OF AUSTRALIA, CHINA, MALAYSIA, THAILAND AND INDONESIA

In the recent past, there is an increasing trend towards dry leasing of helicopters from helicopter leasing companies dedicated to this segment of business. Dry leasing implies leasing of the platform and not the flying crew with it. By the end of 2016, operators of civil and commercial helicopters in the Asia-Pacific region had more than 170 helicopters that were taken on dry lease from different leasing firms. Amongst the nations in the Asia-Pacific region, Australia tops the list with 60 helicopters being operated on dry lease in a number of roles such as offshore operations, emergency medical services and other multi-mission roles. India is figuring next on the list with 28 helicopters on dry lease being operated primarily for missions related to logistic support to oil platforms on the high seas. Indonesia figures next on the list with 25 helicopters on dry lease with the majority of these being employed for multimission operations. The largest companies in the Asia-Pacific region engaged in the leasing business include Milestone Aviation, Waypoint Leasing, Australia and New Zealand Bank (ANZ), Airwork NZ, Lease Corporation International (LCI) and Eagle Copters.

Helicopters Owned by Countries in the Asia-Pacific

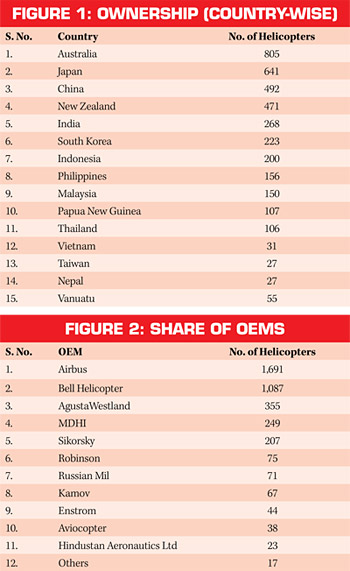

Civil helicopters owned and operated by the major nations in the Asia-Pacific region are tabulated in Figure 1. The fleet of civil helicopters operated by nations in the Asia-Pacific nations are provided by global original equipment manufacturers (OEMs). Number of helicopters provided by the OEMs is tabulated in Figure 2.

Growth of the Helicopter Fleet — Major Operators

China. In the Asia-Pacific region, China, Hong Kong, Macau and Taiwan which together is generally described as Greater China, has been the fastest-growing market in the region. Over the last decade, the civil helicopter fleet of Greater China has registered a 20.5 per cent year on year growth. In the wake of the indication by the Civil Aviation Administration of China (CAAC) in its 12th Five Year Plan of intentions towards developing and exploiting the full potential of general aviation, there have been major changes in policy, easing of regulatory provisions, development of infrastructure and investment in the indigenous aerospace industry. With all these, the general aviation segment of the aviation industry in China is likely to get a major boost on account of which, the growth rate in the civil helicopter fleet of China will not only be sustained; but is expected to rise in the years to come.

Australia. This nation represents largest helicopter market in the Asia-Pacific region. However, in the year 2016, the civil helicopter fleet in Australia grew only by a meagre 2 per cent reflecting a distinct slowdown in many of the roles the fleet is employed in. However, there has been growth in the emergency medical services segment wherein there has been a significant increase in the size of the fleet.

India. In India, during the year gone by, the size of the civil helicopter fleet saw a marginal increase by a mere 1 per cent. However, with more progressive policies formulated by the Ministry of Civil Aviation as well as substantial increase in oil exploration in the Indian Ocean, the demand for helicopters both inland and for offshore commitments is likely to increase.

Indonesia. During the year 2016, there has been stagnation in the fleet size in Indonesia with rate of growth at zero, primarily on account of the downturn in the exploration activities in the oil and gas and other sectors related to resources. The situation has also been impacted by new regulations under which helicopters will not be permitted to operate beyond the airframe life of 30 years. Also, import of helicopters above 10 years of airframe life will no longer be permitted.

Japan. Today the most industrialised nation in the Asia-Pacific region and perhaps also the most affluent has been employing civil or commercial rotary-wing platforms for long in roles such as search and rescue, emergency medical services and law enforcement. The nation also has the largest fleet of civil helicopters in the Asia-Pacific region which in the year 2016 grew only by 2 per cent. Airbus and Leonardo (AgustaWestland) have the credit for delivering the largest number of platforms to Japan during the year gone by.

Malaysia. The slowdown in the offshore oil and gas industry impacted the helicopter fleet of Malaysia as well. Around 33 per cent of the fleet is deployed in this sector. Besides, helicopters employed by the corporate world also did not register growth as many of the platforms engaged in this role have switched over to multi-mission roles. Overall, there was a marginal reduction in the size of the fleet in Malaysia.

New Zealand. During 2016, the strength of the rotary-wing fleet in New Zealand increased from 440 to 471, a growth rate of 7 per cent. In the region, this fleet boasts of having the largest number of helicopters from MDHI and a majority of these are employed for multi-mission operations.

Conclusion

Over the years, the fleet of helicopters in the Asia-Pacific region has evolved into one that covers a wide variety of mission profiles. Multi-mission role commands 54 per cent of the fleet, the corporate world accounts for 12 per cent, private and private use corners 12 per cent, search and rescue engages 7 per cent and emergency medical services utilise 5 per cent of the resources. For the rotary-wing fleet in the Asia-Pacific region, the future appears to be quite promising as despite the reduction in global demand for helicopters as also the uncertainties afflicting the offshore oil and gas sector, demand for helicopters in Asia-Pacific region still appears set to grow. Apart from China that is expected to continue to lead the growth story, the other emerging markets such as in India, Indonesia and the Philippines, are also expected to contribute to the growing Asia-Pacific helicopter market.