Competing with Goliaths

Regional airlines have cranked up daily aircraft utilisation in order to reduce unit costs and survive in India’s highly-competitive domestic low-fare environment

What a difference six years make. The frenzy with which airlines in India added aircraft to their fleets near the end of the last decade seems ominously familiar today as new carriers enter the domestic market and bring hundreds of new airplanes with them. Where is all that capacity to be placed and is there sufficient demand to fill the seats at sustainable ticket prices without duplicating the fare wars that led to the demise of several airlines in the late 1990s?

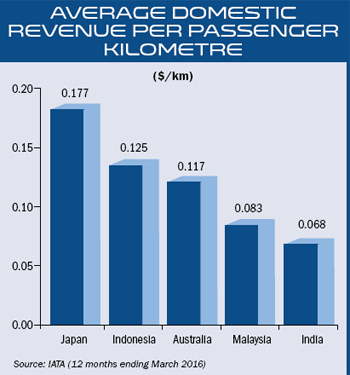

Today’s landscape is dramatically different – domestic revenue passenger kilometres are growing at double digits, the price of jet fuel is substantially lower, cabin load factors are healthy, carriers are making profits, incentives are in place to support a regional connectivity scheme, and underserved airports are getting more attention. Yet there are still some 130 non-stop flights every business day between Delhi and Mumbai with ticket prices that reflect all that capacity. It may be one of the reasons why domestic airfares (yields) in India have remained so chronically low compared to other countries with local airline networks.

Small Airplanes and Low Yields

Those weak domestic yields make it tough for independent carriers with smaller-capacity regional jets to compete with the pricing power of India’s low-fare airlines especially when they, themselves, enter low-demand, secondary markets with highdensity, one-size-fits-all 180-seat A320s.

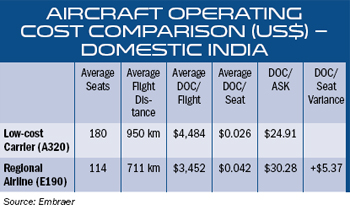

Compared to larger single-aisle aircraft, regional jets have fewer revenue-generating seats and flown seat-kilometres over which to amortize costs. They fly shorter routes, often complete more cycles per day and, consequently, have higher direct operating unit costs, measured per available seat kilometre (DOC/ASK.)

Short-haul flights normally command higher fares per kilometer than long-haul flights. Regional airlines, in particular, must recover the fixed costs associated with taking off and landing (terminal charges, maintenance, passenger processing, airport fees) without amortizing those expenses over a long distance.

The fare-distance relationship is generally true today yet low-cost carriers (LCCs) may be pushing ticket prices lower on short-haul routes and where seat supply often exceeds passenger demand.

Too Many Seats Upsets the Regional Fare Mix

Travellers with a high value of time pay a premium for schedule convenience, a characteristic of regional airlines that fly smallercapacity aircraft frequently. The mix of high and low-fare passengers on a regional jet is usually sufficient to make a flight economically viable. In secondary markets of, say, 200 daily each-way passengers, a 100-seat regional jet can offer three daily directional flights timed to satisfy morning and evening peak and midday off-peak demand. Price-sensitive travellers are often attracted to discounted fares on non-peak flights, an incentive that helps distribute demand more evenly throughout the day.

But aircraft with too many seats in a 200 daily each-way passenger market can skew the fare mix. LCCs, looking to deploy their large airplanes after satisfying morning peak demand on Tier-I routes, routinely schedule midday flights to Tier-II or even Tier-III regional markets before the aircraft return to the primary city pairs for the evening peak. The extra flying generates more flight hours that serve to keep unit costs down but the big airplanes offer seats where there is little or no demand for them. Consequently, tickets are sold at deep discounts simply to generate cash in an attempt to stimulate sales. While a 180-seater may, in fact, break even on a Tier-II or Tier-III route, the abundance of bottom-priced seats negatively impacts a regional carrier’s own fare mix when it is forced to match its competitor’s low prices on the same city pair.

Heavily discounted fares in one market can also impact nearby markets that aren’t even served by LCCs. Online travel search engines make shopping for airfares completely transparent. Smart consumers can easily find more attractive fares and schedules in neighbouring cities.

Cranking Utilization Up to Keep Unit Costs Down

Unless regional carriers have sweet financial arrangements with their co-branded mainline partner airlines to cover their operating costs for feeder flights (as most regionals do in the United States), regional jet operators in India face a tough battle in the new low-fare environment. Their aircraft need to work harder to ensure maximum daily utilisation so that unit costs are rock bottom. This is already happening. Each of Air Costa’s four E-Jets, for example, was flying a whopping 12.6 hours per day on average in late May. And those E190s were working hard – some aircraft completed ten daily flights with just 20 to 30 minutes on the ground between each arrival and departure. That utilisation corresponds to about 3,600 annual block hours per E190, about the same as an A320 in a LCC fleet, yet each E190 flight is about one-third shorter and has one-third fewer revenue-generating seats.

The productivity of Air Costa’s fleet is impressive. Even with such high daily utilisation, its average flight DOC per seat is still greater than that of a LCC. In other words, on their current route networks, the E190 would need to reduce its operating cost by a further $612 per flight to have the same cost per seat as a LCC’s A320. It’s the equivalent of the airline adding between Rs. 350 and Rs. 500 to the price of every E190 ticket sold (depending on load factor) just to offset the LCC’s big-jet cost advantage.

Maintaining a Healthy Balance

The key to sustaining regional jet service in Tier-II and Tier-III markets is having ideally-timed flights that attract a healthy mix of premium-fare business and discount-fare leisure travellers and with just the right frequency to profitably balance the number of seats with the number of passengers. Since regional jet utilisation seems to be at its limit (at least in the case of Air Costa), it may be difficult to further reduce unit costs unless there are untapped economies of scale that could be derived from operating larger fleets, or there are further concessions granted to carriers with regional aircraft.

It puts renewed focus on domestic fare levels and the influence LCCs have on an emerging, fragile regional industry. As sure as night follows day, what goes down will eventually come back up: the honeymoon with cheap jet fuel will end. When that happens, carriers with big airplanes might well be forced to rethink at what price they should sell their surplus seats and whether it makes economic sense to be flying those aircraft on low-demand routes that are better suited to smaller regional jets.