Embraer expects 5500 new aircraft demand

The Brazil manufacturer expects the coronavirus crisis initiate rightsizing, regionalisation and environmental awareness as a shift in aviation industry

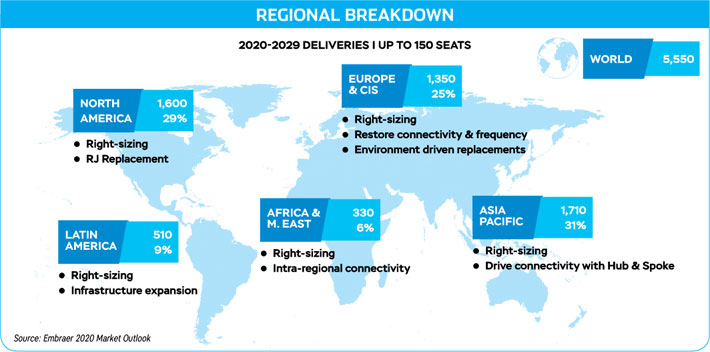

As the industry rebuilds itself after the historically disruptive coronavirus pandemic, earlier this month Embraer released its new market ook for the next decade stating that the manufacturer expects 5,500 new aircraft deliveries in the up to 150-seat category. Global passenger traffic is likely to grow 2.6 per cent annually with China and Latin America leading the increase, based on the trends identified in the released outlook.

The Brazil manufacturer’s newly published 2020 Commercial Market Outlook examined passenger demand for air travel and new aircraft deliveries over the next 10 years with special emphasis on Embraer’s product segment - aircraft up to 150 seats. The report noted some of the emerging trends that will influence growth, factors shaping future airline fleets, and the regions of the world that will lead demand in the commercial sector. The report also highlighted the driving force behind aircraft acquisitions, and details deliveries by aircraft segment for 5 world regions.

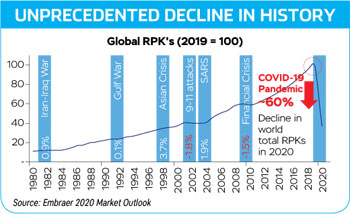

As a long term impact of the pandemic, Embraer sees a persistent loss of 5 per cent in GDP levels by 2030. The crisis due to the novel coronavirus has brought about an unprecedented decline in history and has permanently skewed the curve, the manufacturer highlighted. Nothing compared to the 60 per cent decline as being seen in 2020 has even been witnessed.

Speaking during the online presentation of the report, Embraer Commercial Aviation Vice President of Marketing Rodrigo Silva e Souza stated the Covid pandemic to be the most serious crisis the industry ever has faced, citing a 60 per cent decline in revenue passenger kilometers (RPKs) in 2020 compared to the 1.8 per cent decline resulting from the 9/11 tragedies and a 1.5 per cent fall during the financial crisis of 2008-2009. Embraer sees RPKs returning to 2019 levels by 2024, but remaining 19 per cent below the levels the company previously forecast through 2029.

Rightsizing i.e. adjusting to new volumes and focusing on profitability is going to be the key. Jets up to 150 seats have been favoured in airline’s fleet decisions lately, the outlook report stated.

At the end of the decade Revenue Passenger Kilometres (RPK) is expected to be 19 per cent lesser than what it was in earlier period. The company expects that in the next four to five years the levels might restore back to what it was in 2019. It is likely to restore in 2020-2024 period, then grow in the 2025-2029 period but and overall the growth is still likely to be lower than the previous 10 year period leading to a 19 per cent smaller RPK, the report pointed out.

“The commercial aviation industry will be smaller. This is the consensus in the industry. It will take years for it to come back and when it does come back we believe that growth rates will be significantly lower than we had before. It will also have a different shape, so changes in global trade flows, changes in passenger behaviors, will for sure lead to changes in the air travel industry and passenger flows, leading to a different industry,” said Silva. He also added that those changes will, consequently, lead to a different global fleet profile, favoring aircraft in the categories in which Embraer’s product line resides.

The global pandemic is causing fundamental changes that are reshaping air travel patterns and demand for new aircraft. The four main drivers noted in the report were as follows:

- Fleet Rightsizing - a shift to smaller-capacity, more versatile aircraft to match weaker demand. Rightsizing i.e. adjusting to new volumes and focusing on profitability is going to be the key. Jets up to 150 seats have been favoured in airline’s fleet decisions lately, the outlook report stated. It’s all about using the right aircraft size for the demand that is out there. With a lower demand, we believe this will drive the average aircraft size downward, Silva said.

- Regionalisation - companies seeking to protect their supply chains from external shocks will bring businesses closer, generating new traffic flows. Regionalisation in the sense of business turning inwards and establishing new flows is going to be significant. With the slowdown of Global Trade already being a trend, COVID-19 has put the emphasis on local production to reduce risk of future supply shocks.

- Passenger Behavior - preference for shorter-haul flights and decentralisation of offices from large urban centers will require more diverse air networks. The company also highlighted its prediction about decentralisation of offices from large urban centers resulting in more diverse air networks and passenger behavior trending toward a preference for more short-haul flights and more environmentally friendly modes of transport.

- Environment - renewed focus on more efficient, greener aircraft types.

“Instead of a daily commute inside a city, perhaps we will see short flights between secondary cities and big centers once, twice a week, or three times, and people prioritising the quality of life in smaller centers,” Silva said.

Describing the new passenger behavior, the outlook report recognised that technology, health and environmental awareness will influence the decisions of new passenger behavior.

A digital revolution categorised by wide adoption of virtual communications and services will see e-commerce growth and enhanced information access accompanied by work from home trend which is likely to lead to multi-purpose trips (B-leisure) and decentralisation from large urban centers alongside partial substitution of business travel by virtual interactions.

Health concerns especially looking for crowd rejections will bring transitions in how the passengers travel as well as where they travel. The preference for an individual means of transportation, optimised travel time, shift to less mainstream destinations, preference to domestic destinations and a strong sense of hygiene and sanitation requirements which will drive the choice of airline, are all expected to come to the forefront.

When it comes to the environmental awareness, more green solutions, eco-friendly airlines, diversification of transportation means and a need for sustainable growth through alternative tourism is likely to create shifts. On the environmental front it also needs bigger governmental role and hence a growing impact of ESGs.

“The short-term impact of the global pandemic has long-term implications for new aircraft demand. Our forecast reflects some of the trends we’re already seeing - the early retirement of older and less efficient aircraft, a preference for more profitable smaller airplanes to match weaker demand, and the growing importance of domestic and regional airline networks in the restoration of air service,” said Arjan Meijer, President and CEO of Embraer Commercial Aviation.

“The short-term impact of the global pandemic has long-term implications for new aircraft demand,” said Arjan Meijer, President and CEO of Embraer Commercial Aviation. “Our forecast reflects some of the trends we’re already seeing - the early retirement of older and less efficient aircraft, a preference for more profitable smaller airplanes to match weaker demand, and the growing importance of domestic and regional airline networks in the restoration of air service. Aircraft with up to 150 seats will be instrumental in how quickly our industry recovers.”

Some of the selected highlights from the commercial outlook included:

TRAFFIC GROWTH

- Global passenger traffic (measured in RPKs) will return to 2019 levels by 2024, yet remain 19 per cent below Embraer’s previous forecast through the decade, to 2029.

- RPKs in Asia Pacific will grow the fastest (3.4 per cent annually).

- 4,420 new jets up to 150 seats will be delivered through 2029.

- 75 per cent of deliveries will replace ageing aircraft, 25 per cent representing market growth.

- The majority will be to airlines in North America (1,520 units) and Asia Pacific (1,220).

- 1,080 new turboprops will be delivered through 2029.

- The majority will be to airlines in China/Asia Pacific (490 units) and Europe (190).

JET DELIVERIES

TURBOPROP DELIVERIES

When asked about the future of turboprops and the reason Embraer was looking at their revival, the executives mentioned that they are still recognising and analysing the different perspectives especially in terms of the size but turboprops and jets are indeed the markets that Embraer is looking at.

“We are looking at between 70 and 100 seats. Another possibility that we believe would be an upside for this programme would be the replacement of 50 seaters in United States because in some cases it is too limited to 50 seats. And the turboprop can replace those 50 seaters for much more feasibility and efficiency to carry,” said Silva.

He further added that he believes a main reason for the weak market of turboprops in regions like North America is also the bad perception on the passenger experience regarding flying on turboprops which they are certain to change with their efficient e-jets over time.

While Meijer added that because of this crisis like never before, things are quite unpredictable but we believe that a change in behavior is likely to occur.

While presenting the market outlook Silva also took note of the social consequences of the pandemic, which has had a large impact on low-income people, whose upward mobility had created a strong base for significant growth in the airline industry. And now with this consequential downfall in the growth of this section of the society due to the pandemic, the demand for commercial aircraft is also expected to take a toll, contributing to a “re-calibration of the industry at large, leading to a shift, most significantly for Embraer, in the demand profile for commercial airplanes,” Silva noted.